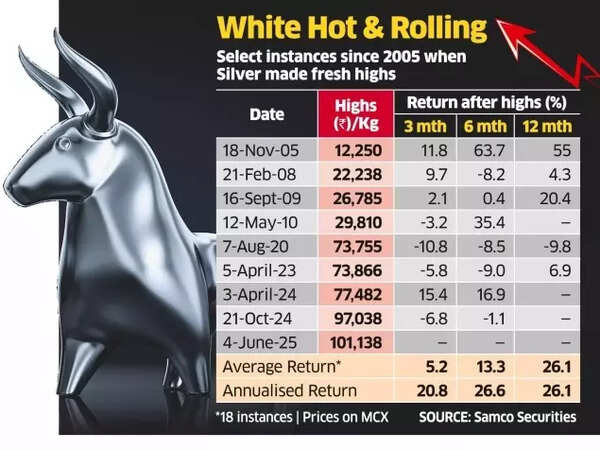

Gold vs silver: Silver prices have reached a significant milestone, surpassing $36 per ounce in international markets, marking their highest level in 13 years during the previous week. Market analysts anticipate the precious metal to align with gold’s performance, supported by favourable technical indicators and increased demand driven by a weakening dollar.2025 has seen international gold prices rising by 43.7%, driven by increased demand for secure investments amidst Donald Trump’s tariff policies and global political tensions. Silver has increased by 22.3%. In contrast, the Nifty 50 has risen by 5.7%, whilst Nifty Midcap 150 has grown by 3.6%, and the Smallcap 250 index has decreased by 1.3%.Historical data from Samco Securities quoted in an ET report shows silver’s characteristic rapid price movements. Since 2005, in 17 instances of reaching new highs, the metal has delivered average returns of 5.2%, 13.3%, and 26.1% over three-month, six-month, and one-year periods, respectively.

Silver Prices Historically

Silver shows signs of a technical breakthrough, experts say. Apurva Sheth of Samco Securities notes the presence of a distinctive ‘Cup and Handle’ pattern visible on both weekly and yearly charts.“This technical formation is often a precursor to explosive breakouts. What makes this instance remarkable is its repetition across timeframes, hinting at deep market structure alignment,” said Sheth.On Monday, silver traded at $36.3 per ounce, showing a 0.9% increase in international markets. The metal was valued at ₹1,05,520 per kilogram on MCX in India.“With gold likely to consolidate after a strong run, silver has the potential to outperform,” said Ritesh Jain, founder, Pinetree Macro. “If silver holds above $36, it could retest the $50 highs seen during the Hunt Brothers era by the end of this year.”Also Read | Gold price rise impact: Value of RBI’s gold surges 57% to Rs 4.32 lakh croreTrading opportunities in silver are available through various instruments including Silver Exchange-traded Funds, Silver Fund of Funds, or Silver futures trading on MCX.According to Ramesh Varakhedkar of ICICI Securities, several factors support the anticipated silver rally, including a weakening US dollar, improving US-China trade relations, and the European Central Bank’s seventh successive rate reduction.Varakhedkar emphasises silver’s importance as both a financial instrument and industrial commodity in the current market scenario.The gold to silver ratio, indicating the number of silver ounces needed to purchase one ounce of gold, reached 91.3 on Monday, marking its lowest point since April 2, noted Varakhedkar. This metric suggests silver presents better value currently. The ratio had previously peaked at 126.55 in March 2020, after which silver prices doubled by August.“In the short-term, silver could rise further to around $37.2, and on the MCX, Silver July contract, short-term price range is expected between ₹102,400 and ₹108,200 per kilogram, provided it maintains above ₹102,400 (currently at ₹1,05,520),” said Varakhedkar.Also Read | Gold vs Nifty 50: Yellow metal emerges as best performing asset in FY25, but Indian equities outperform in long-term